Cashwiz, Fintech App

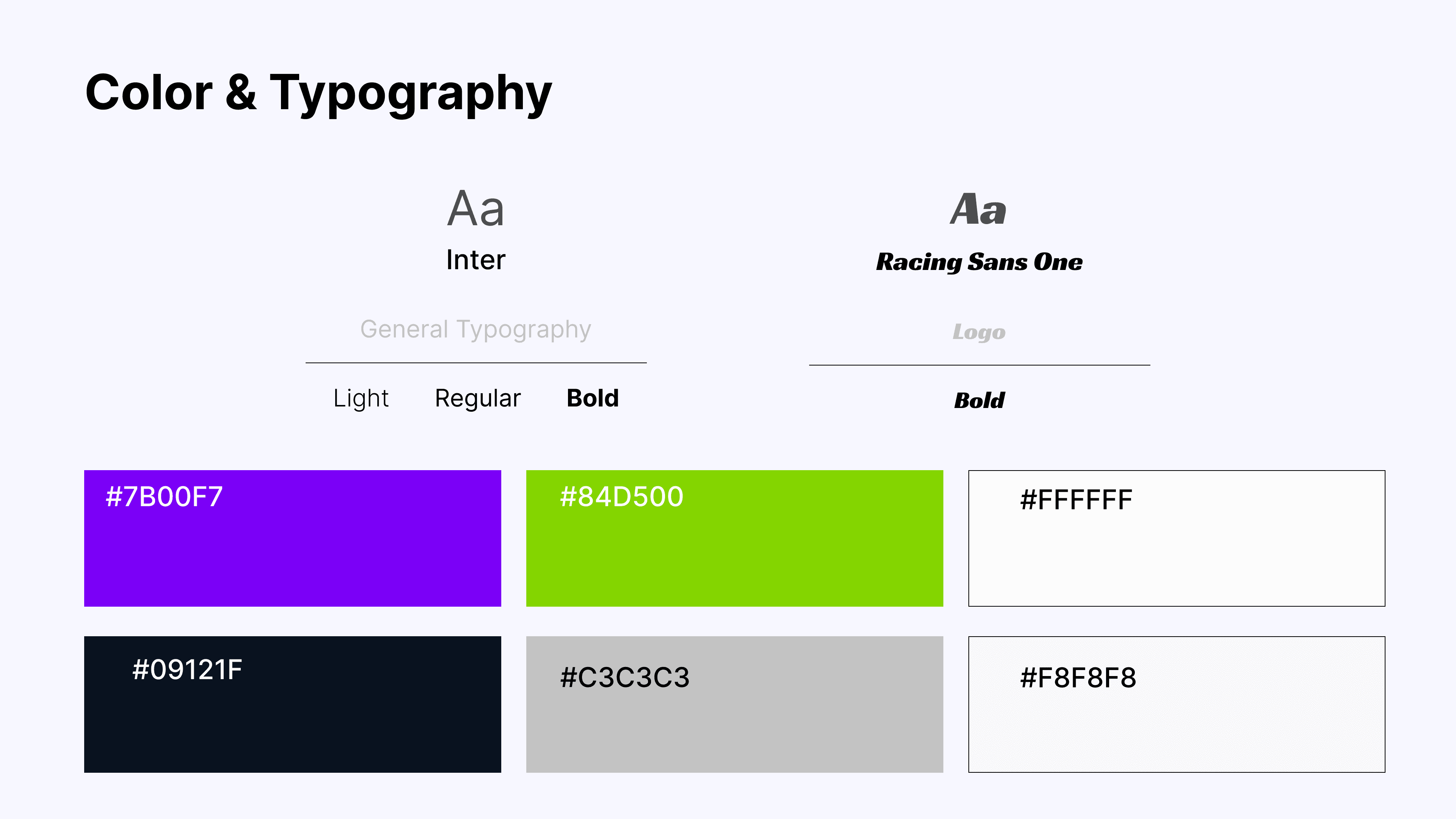

As part of the Techcareer Bootcamp, I designed cashwiz, a social banking app concept aimed at simplifying shared expenses and encouraging better financial habits for young adults. The app focuses on making it easier for friends to split bills, track payments, and send requests for money, all while providing budgeting tools and savings incentives through gamification. The design is targeted at young adults, combining an intuitive interface with playful visual elements and engaging functionality.

Problem Statement

Managing shared expenses can be a challenge, especially for young people who are often navigating social activities, group payments, and personal budgeting for the first time. Traditional banking apps are too formal or complex for this demographic, and many young users lack the motivation or tools to effectively manage their finances.

Key Challenges

Simplifying group payments and expense tracking in social settings.

Encouraging young users to save money through fun, gamified features.

Making personal finance more accessible and less intimidating for a tech-savvy, young audience.

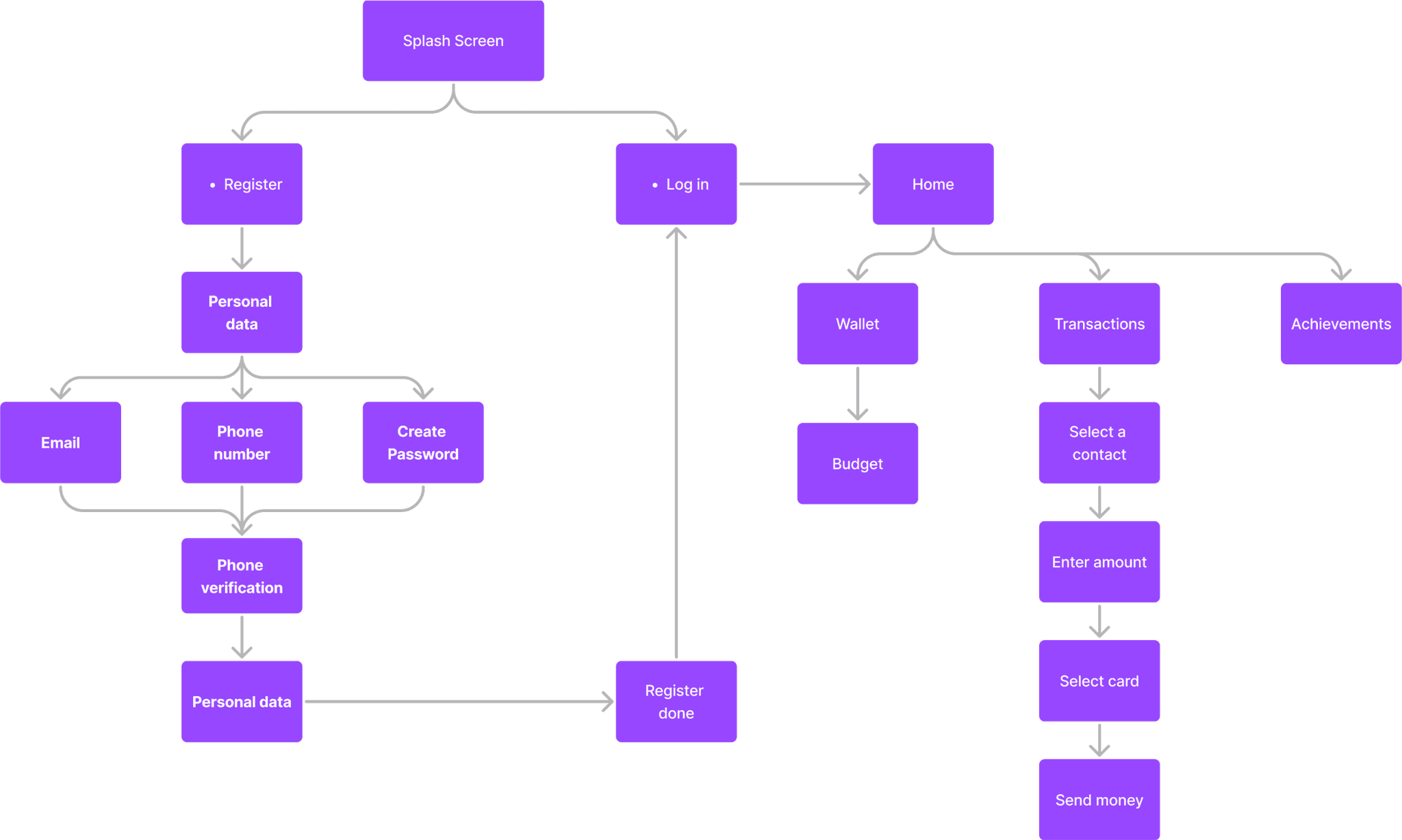

Design Process

Persona Development: To ensure that CashWiz met the needs of its target audience, I created a detailed persona, representing a typical user of the app. This persona helped guide design decisions and ensured the app catered to users like Linda.

Ideation

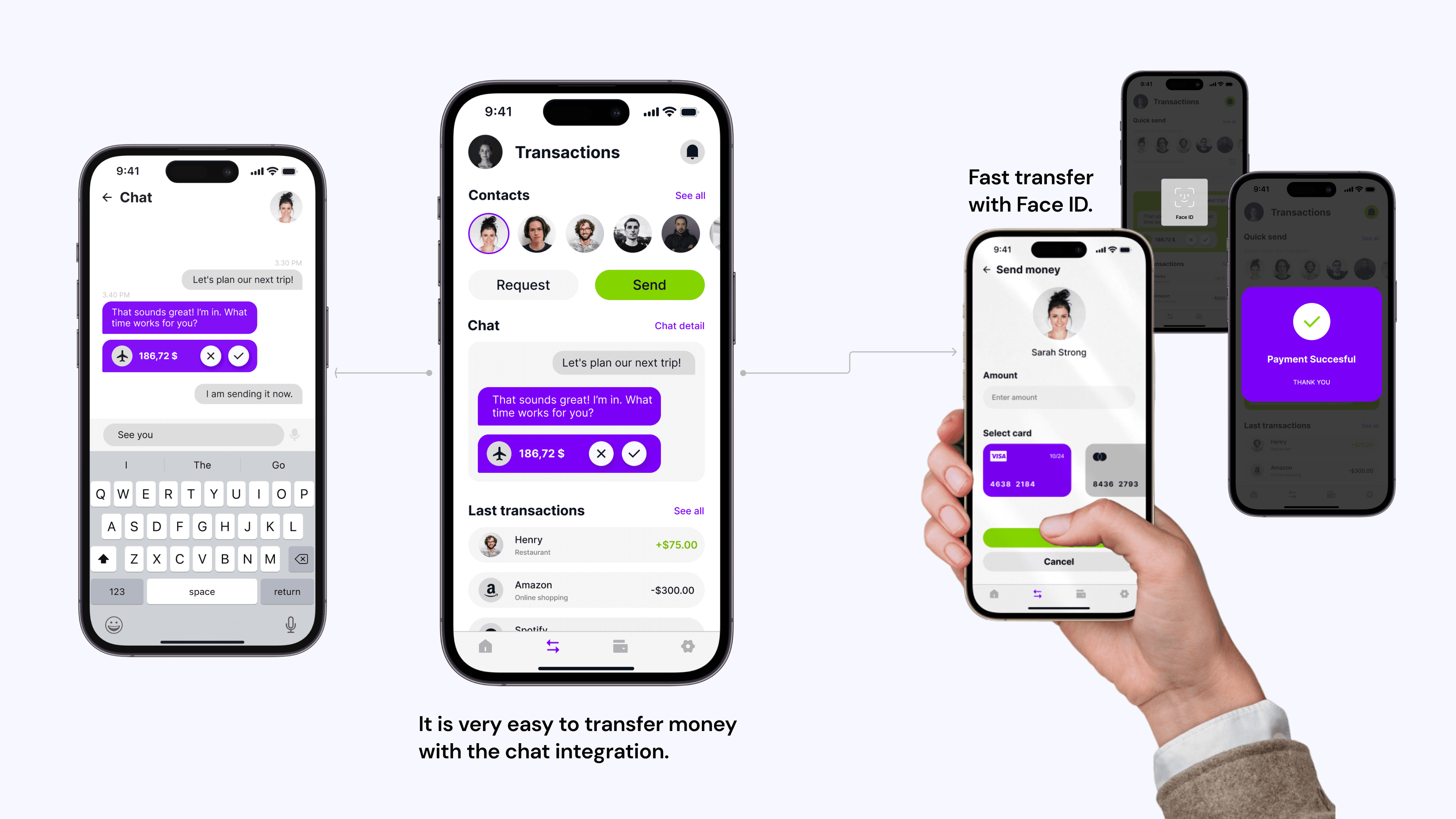

After defining the persona, I brainstormed features and interactions that would appeal to users like Sarah. The primary goal was to create an experience that felt natural and social, yet functional. I focused on designing intuitive features like the ability to split bills and request payments within a chat-like environment. This would allow users to handle their financial interactions in a way that felt familiar and easy to use.

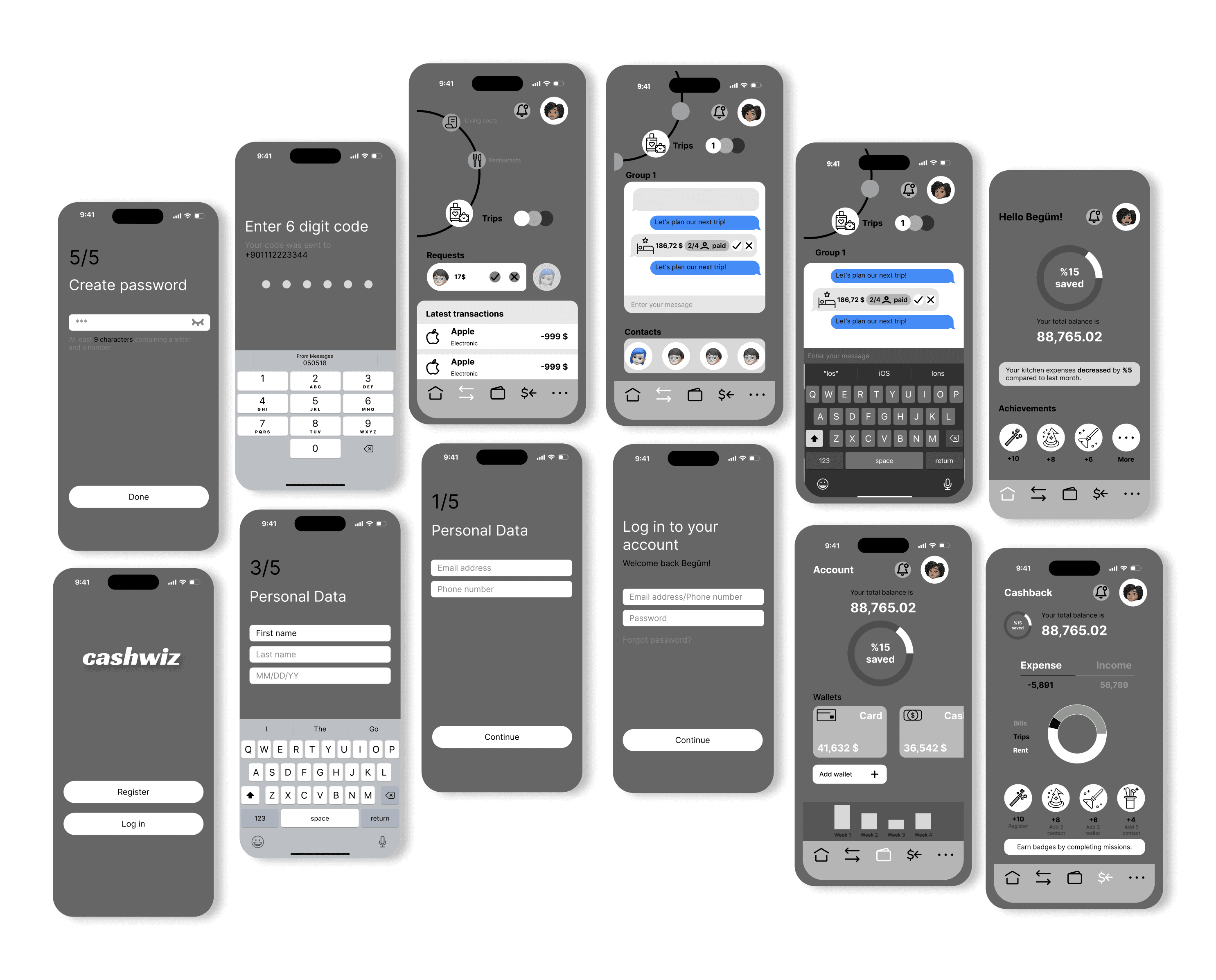

Wireframes

I created low-fidelity wireframes to visualize the potential design concepts and gather feedback from stakeholders and users.

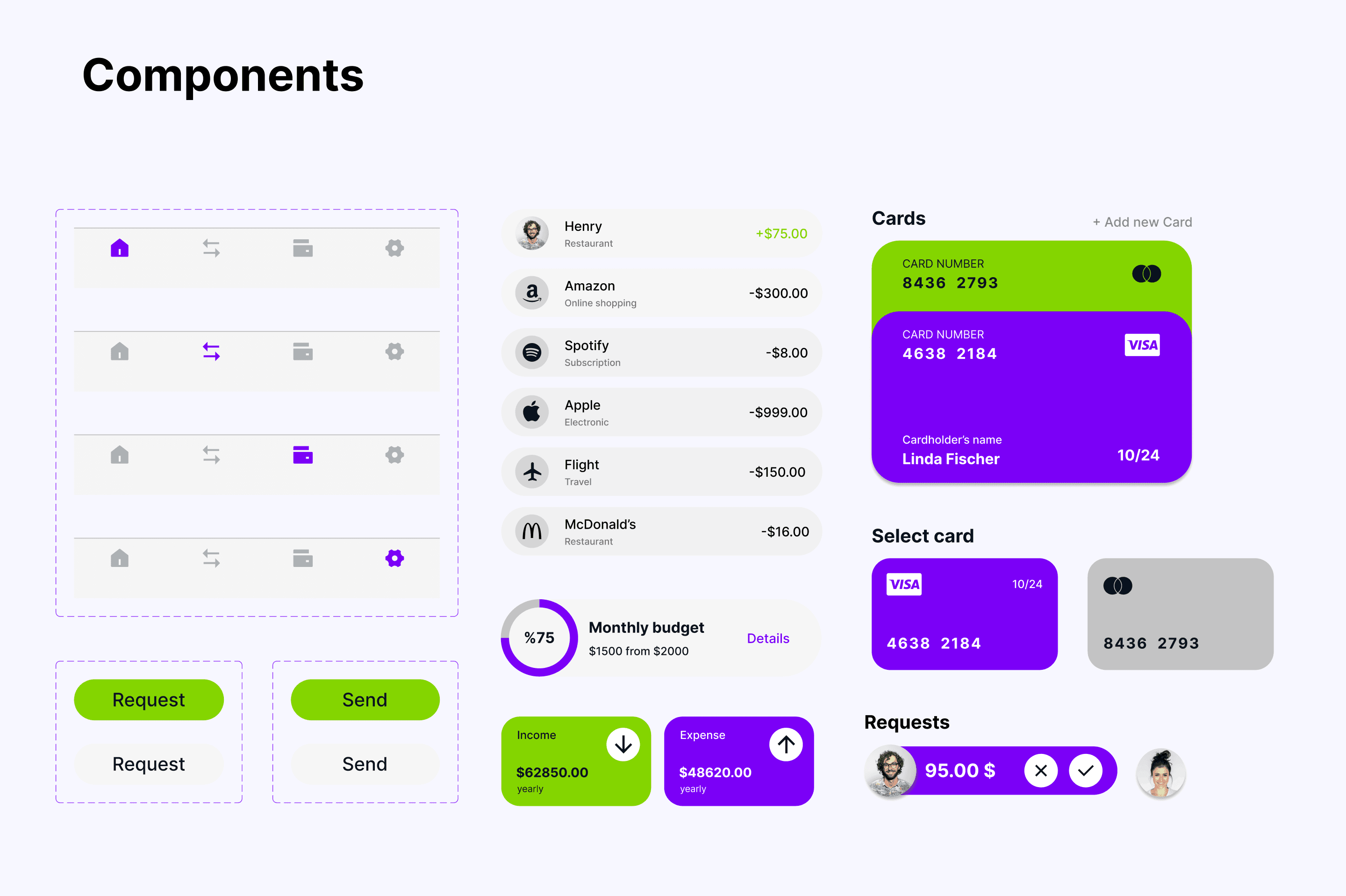

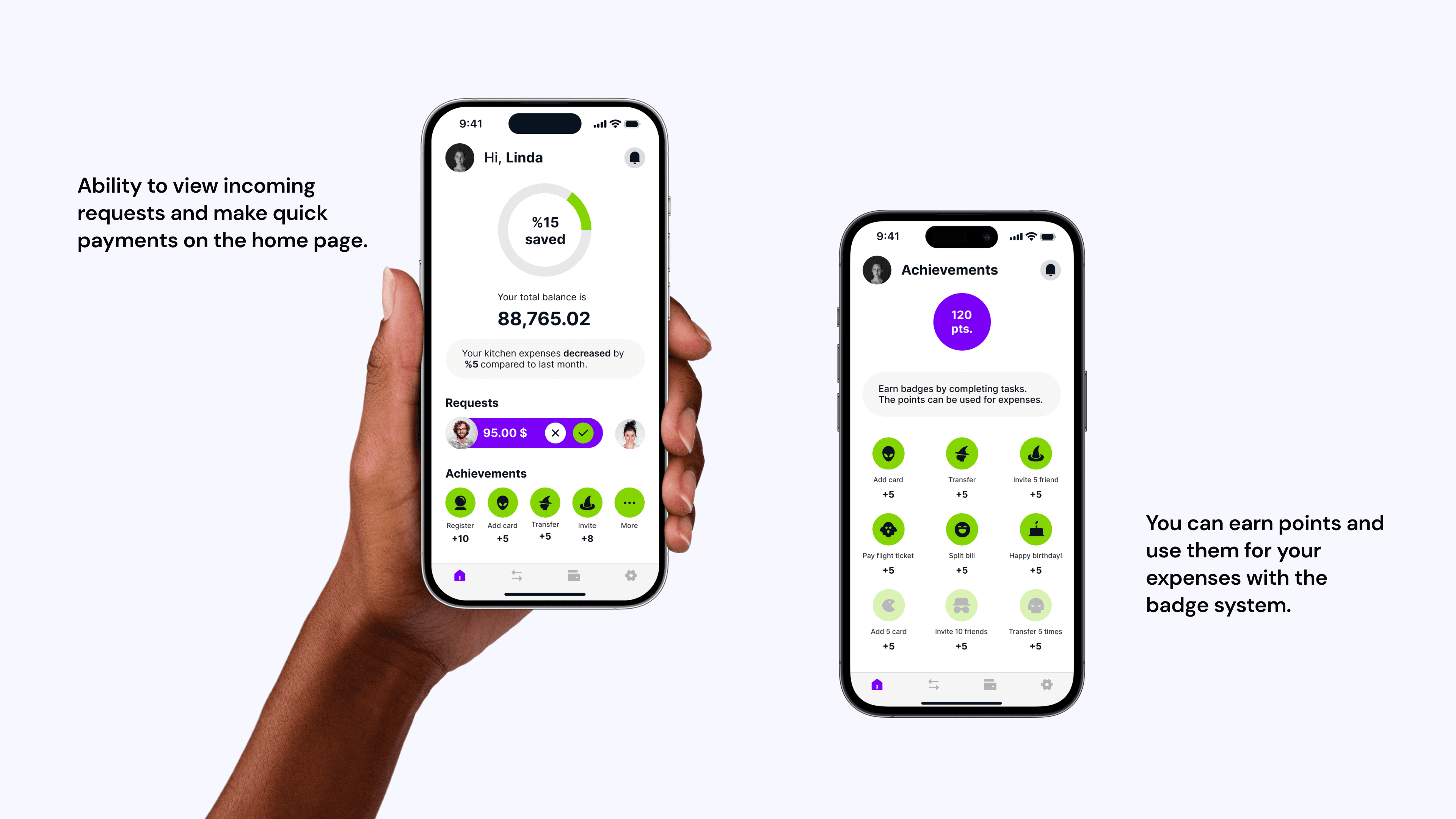

Gamified Savings with Badges

Cashwiz features a badge system that rewards users for achieving savings milestones. Users can collect badges for hitting goals, and these badges translate into points that can be redeemed for rewards within the app, making saving more enjoyable.

Chat-Based Expense Sharing

Users can split bills, track shared expenses, and send payment requests through a chat-based interface. This feature makes financial interactions feel natural, easy, and integrated into everyday social behavior.

Customizable Budget Categories

The app allows users to categorize their spending into areas such as "Food," "Travel," and "Entertainment." This gives users a clear, easy-to-understand overview of where their money is going, helping them make informed financial decisions.

Visual Spending Insights

The app provides users with simple, visual insights into their income and spending patterns. The interface uses charts and progress bars to show how much they’ve spent in each category, helping them adjust their behavior and improve their financial health.

Outcome and Learnings

The final design of cashwiz represents a fresh, engaging approach to social banking. Designed with the needs and preferences of young users in mind, the app seamlessly blends social interactions with personal finance management, using gamification to make saving and budgeting feel more rewarding.

Through this project, I deepened my understanding of designing for a specific demographic and the importance of balancing functionality with user engagement. It was a valuable experience in user-centered design, and it further honed my skills in prototyping and visual storytelling for financial applications.